How do you know if your recruiting process can be more effective—and what interventions can be made to drive greater efficiency? Data-driven recruitment is the secret to bringing in new talent more efficiently and at a lower cost.

An applicant tracking system (ATS) promises to make recruiting more efficient, but it can only do so if people use it properly. At its worst, an ATS is a tool that recruiting teams avoid, making the collection of meaningful data nearly impossible. At its best, an ATS helps recruiting teams complete hiring tasks with ease, collects data that holds everyone in the hiring process accountable, and fosters informed decision-making.

In this post, we’ll cover the two most common areas that recruiting teams are asked to report on through data from the ATS: time and money (source of hire).

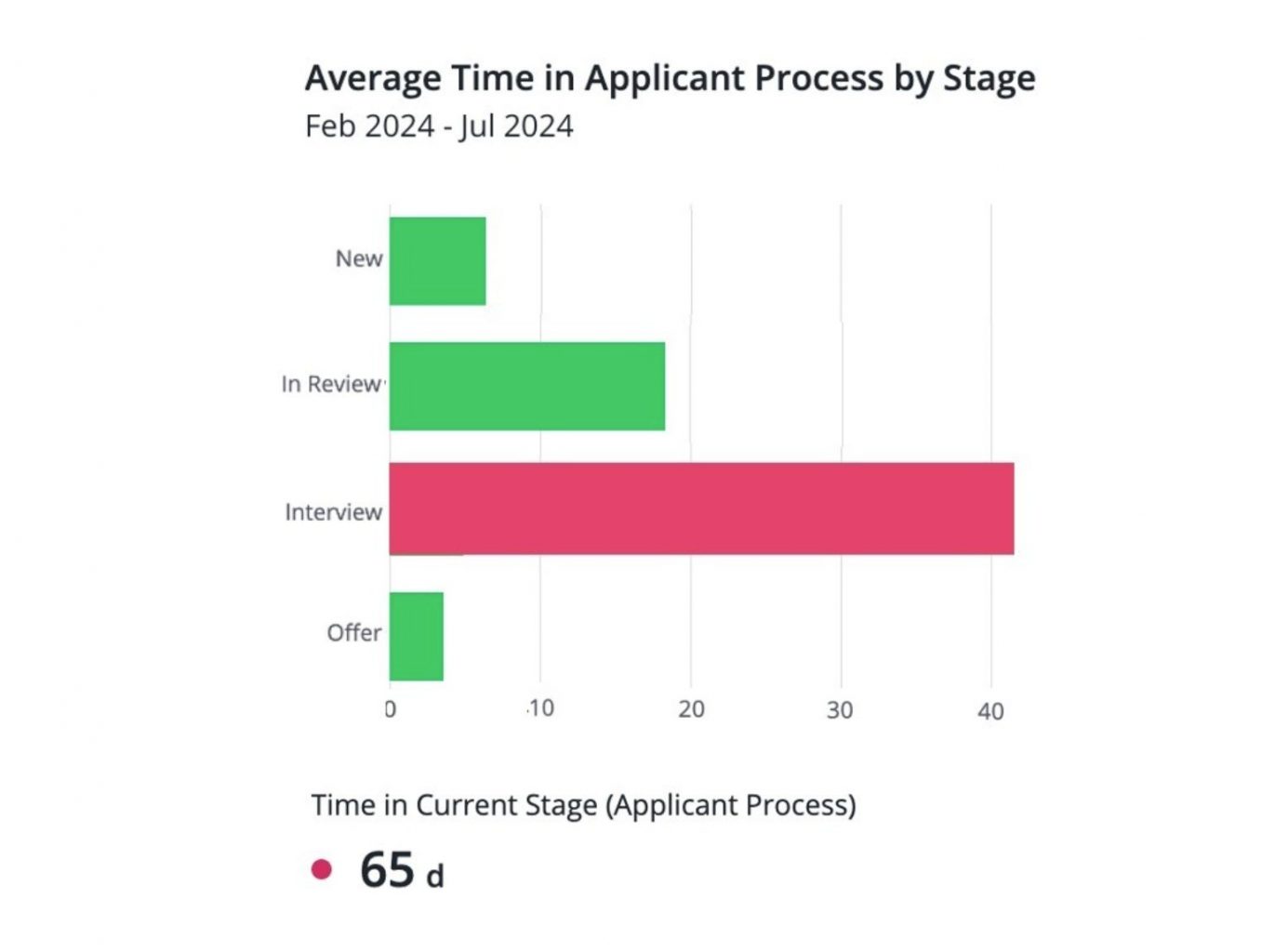

Time: How to become more efficient

“The process takes too long” is one of the most common complaints heard by hiring teams. Achieving greater efficiency requires finding out what’s causing the roadblocks to shorter time frames.

“Time in stage” is a useful measurement that can spark a number of effective interventions when investigated. The following section lists key stages in the hiring process, provides possible causes for long time frames, and potential interventions.

Review stage

If too many applicants are spending too long in the review stage, it could be due to:

- Recruiter workload

- Disposition being delayed until the position is filled

- Hiring managers not reviewing candidates in a timely manner.

Potential solutions include:

- Implementation of conditional screening questions or assessments that cover key hiring criteria

- A tool such as SmartAssistant that identifies best-fit candidates by generating AI-powered scores and recommendations

- SLAs to disposition candidates within a specific time frame

- Automations that progress candidates to the next stage based on specific criteria.

Interview stage

If applicants are spending too long in the interview stage, it could be the result of

- Interview scheduling slowdowns

- Low availability for interviewers

- Interviewers not providing timely candidate feedback

- Difficulty deciding on a candidate

- Difficulty scheduling debriefs.

Potential solutions include

- Interview scheduling integrated with company calendar system

- Candidate self-scheduling

- Feedback reminders in Slack and Teams

- Implementation of hiring scorecards for more equitable candidate assessment

- SLAs for interview debriefs and hiring decisions.

Offer stage

Too long in the offer stage could be related to

- Uncompetitive offers

- Lengthy offer preparation

- Lengthy offer approval

- Background and reference checking.

Potential solutions include

- Better market data on salaries

- Offer template library within the ATS

- SLAs for offer approvers

- Background check and reference check provider integrations with the ATS.

Making comparisons

Comparing time in stage across team members, functions or departments, and regions helps teams uncover where the process is working best and where it can be improved. If one recruiter, department, or region typically moves faster than others, find out what they’re doing that others can learn from. Keep in mind that there are cultural differences across regions and practical differences in hiring times across role types.

Accountability

Regular reviews of time in stage data allow teams to monitor their progress and discuss how interventions are working.

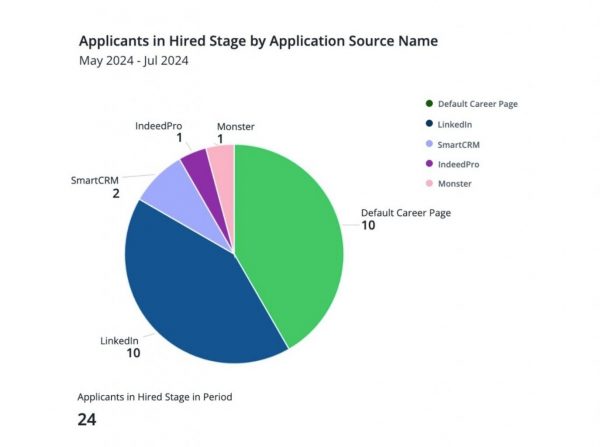

Money: Sourcing analytics

Knowing the advertising channels that net the most hires can help teams allocate spending more effectively, make the case for investing in referrals and internal mobility, and prove the ROI of tools like a CRM.

Understand sources of hire

When looking at the source of hire by role, ask these questions

- What are our best sources of hire?

- What low-cost sources of hire (referrals, internal candidates) can we invest more in?

- Can we allocate our spending across sourcing channels more effectively?

- Which sources of hire bring in diverse candidates?

- How consistently are sources adding value? Perhaps there is some seasonality to certain sources. Is there a way to create consistency, or leverage seasonality with recruitment marketing campaigns?

Understand ratios

When comparing sources of hire against each other, look at ratios. Common ratios include:

- Applicants to interviews

- Applicants to offers

- Interviews to offers

For example, a source that nets many applicants but few interviews may indicate a mismatch in the audience, suggesting that money could be better spent elsewhere.

Making comparisons

As mentioned in the previous section, comparisons across time, role type, and function often provoke further insights. The combination of qualitative (the subjective information about what is happening) and quantitative (what the data says is happening) information offers a powerful entry point into the development of viable solutions.

Promote transparency

Group discussions enable teams to troubleshoot issues and spark ideas for optimization. Export charts into presentations, or host discussions with screensharing and live drill-down. Additionally, shared dashboards can help build a data-driven culture. Getting everyone on the same page will deepen engagement and promote accountability within the hiring team.

SmartAnalytics powers data-driven recruitment

SmartAnalytics from SmartRecruiters enables teams to create an effective reporting strategy that streamlines report creation and delivery, empowering teams to drill down into data and surface insights that lead to faster hiring and potential cost savings. SmartAnalytics offers:

- Customized dashboards: A library of “go-to” dashboards that can be stored in one unified place with metrics that matter most

- Automated report delivery: Scheduled report delivery with permissions for who can view which data elements

- Explore and compare: The ability to make deep-dive comparisons and examine data sets of interest leveraging data visualization

To learn more about SmartRecruiters and SmartAnalytics, sign up for a demo today.