Continue Reading

Return on Hiring

These new metrics not only enable you to strategically evaluate your TA function, they also provide an avenue for you to calculate the financial impact of improving your hiring strategy—your Return on Hiring.

To illustrate this, let’s assume we have Company D, which is composed of the following:

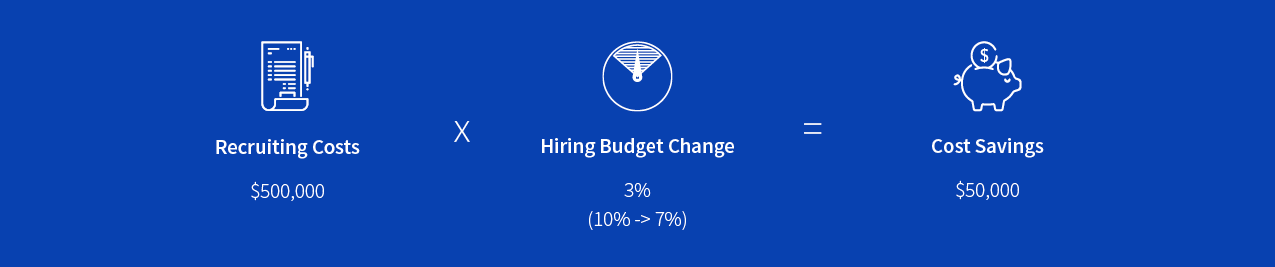

Let’s first examine the financial impact of a more efficient Hiring Budget. As shown below, if you were to improve your Hiring Budget from 10% to 7%, that would save the organization $50k in recruiting costs. The company could then re-invest those savings in attracting better candidates (e.g. improving branding efforts, hiring more recruiters, posting more ads).

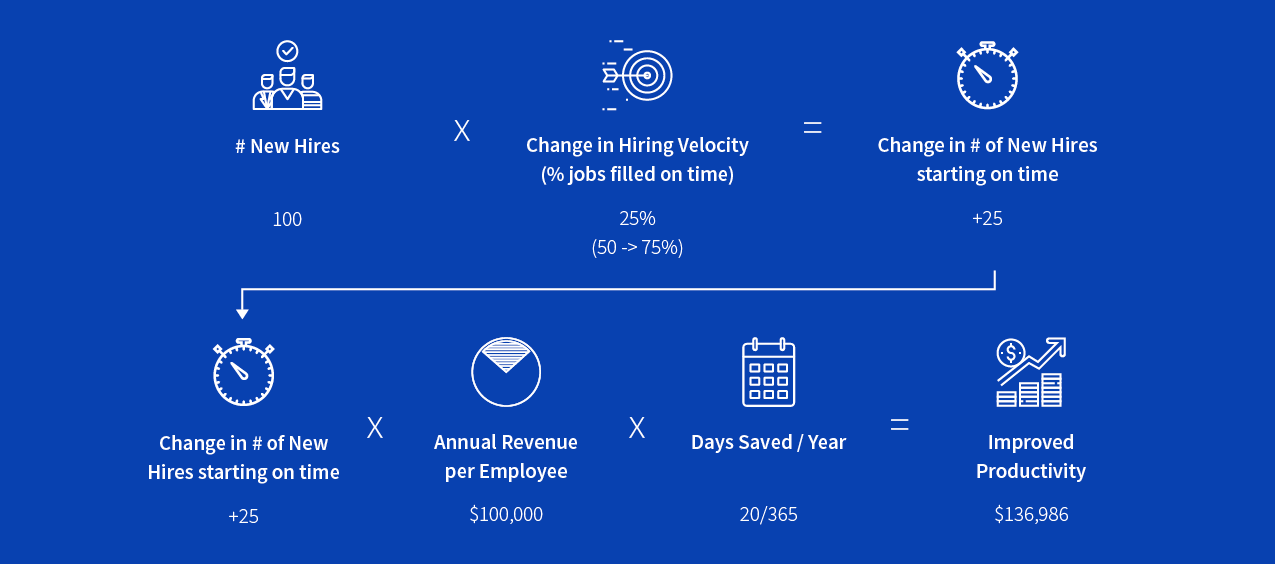

Concerning speed, a company’s ability to fill jobs on time directly affects its ability to scale and boost revenues. A Hiring Velocity of 50% means that 50% of Company D’s open jobs are filled on time. Let’s assume that for the other 50%, there is a delay of ~20 days* between the actual start date and the desired start date.

*According to Indeed, the percentage of jobs remaining open after the following time periods is as follows:

Less than 1 month: 100%

1-2 months: 56%

2-3 months: 40%

3-4 months: 33%

Using this distribution, we can estimate that 50% of jobs still remain open after about ~50 days. If we assume that most organizations attempt close open positions within 30 days, then we can reasonably assume that the average delay between target & actual starts dates is about 20 days (50-30).

As shown below, if the company were to improve its Hiring Velocity from 50% to 75%, an additional 25 new hires could start on time. Organizational productivity would increase by $136,986 as a result of 25 new hires starting on time and generating revenue.

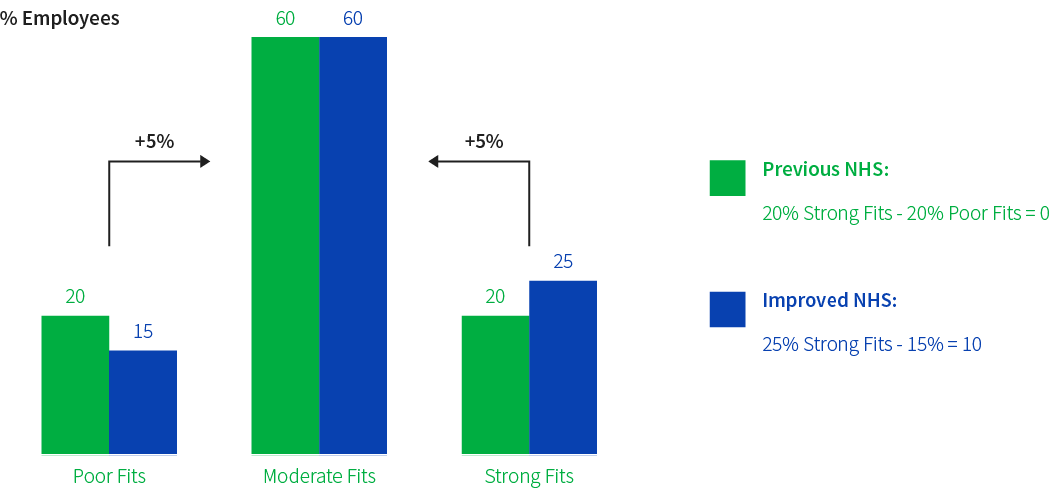

Finally, the most significant impact on Company D’s Return on Hiring comes from improving its Net Hiring Score. Let’s say that with an improved candidate experience and more engaged hiring managers, Company D is able to improve the quality of their overall new hires.

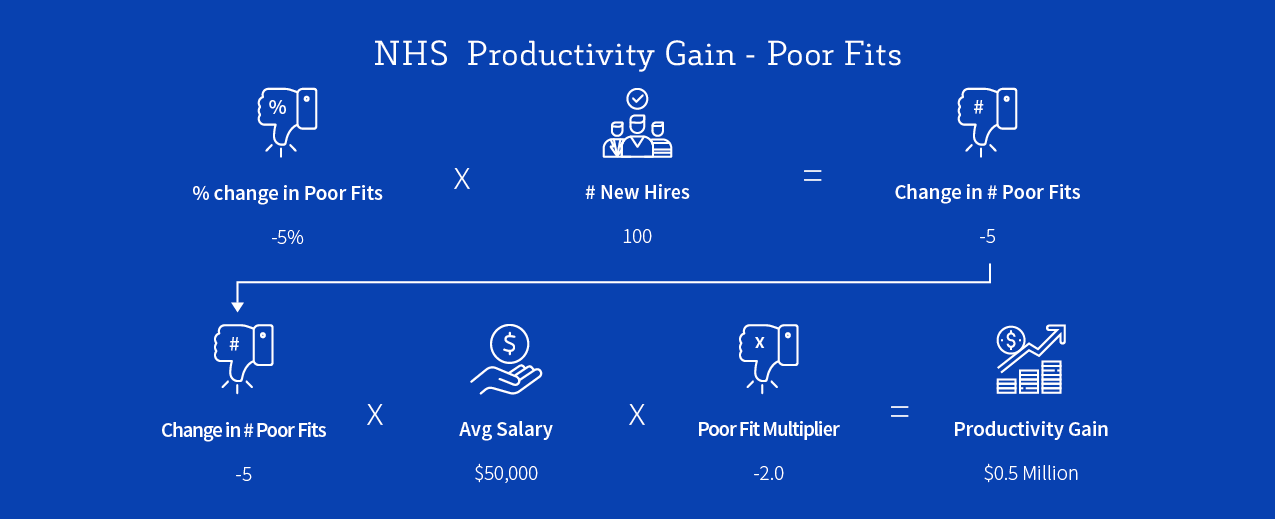

In fact, they were able to elevate 5% of their employees from Poor Fits to Moderate Fits and 5% from Moderate Fits to Strong Fits. As shown below, that translates to a 10 point improvement in the organization’s NHS.

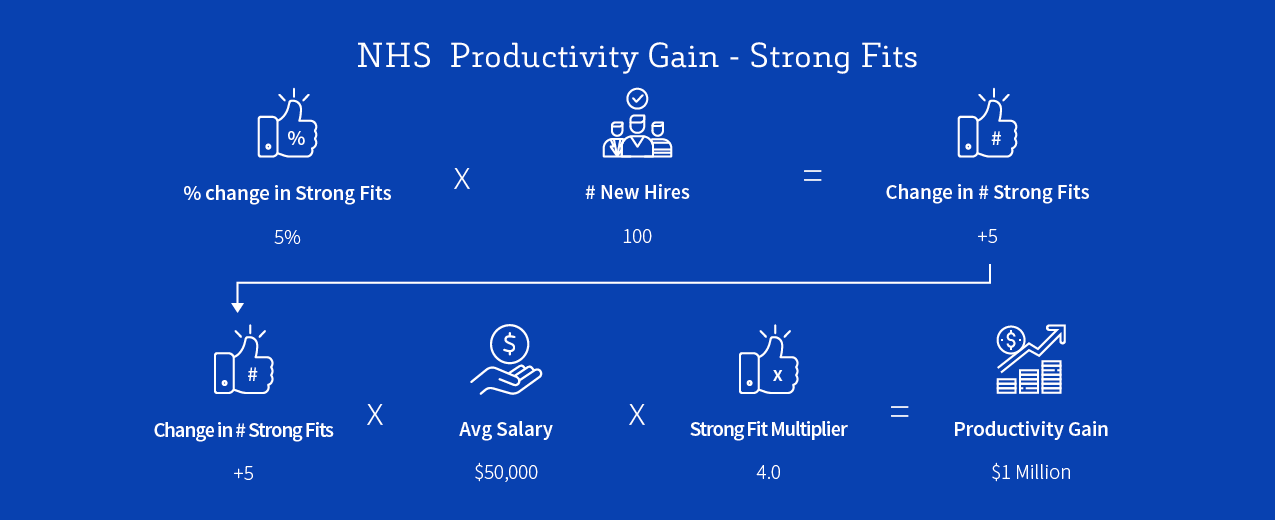

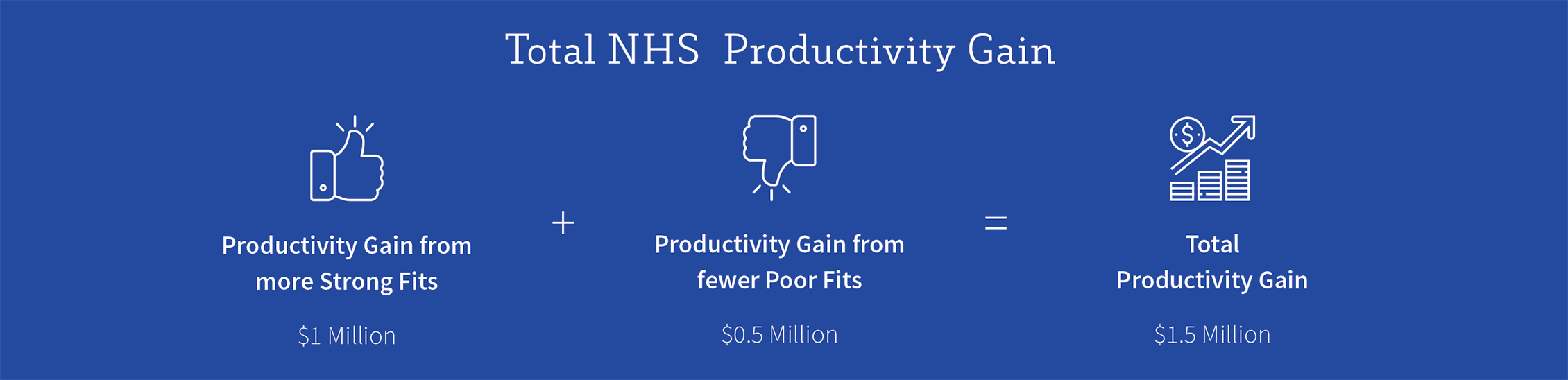

If we assume that Poor Fits cost an organization ~2x their salary and Strong Fits generate 4x* the value of their salary, the overall financial impact will be $1.5m (see below)

*High performer hire multiplier: 4.0;

– Mckinsey Global Analytics: on average, high performers are 400% more productive than average ones

– Harvard Business Review authors Jack Zenger, Joe Folkman, and Scott Edinger, analyzed a database of 50,000 managers and found that top 10% leaders create 15x revenue created by the middle 80%. They also analyzed 24, 826 evaluations on 2,055 individual contributors & found that a top 10% individual contributor is 2x as productive as the middle 30-70% performer

Low Performer multiplier: -2.0

– Harvard Business Review authors Jack Zenger, Joe Folkman, and Scott Edinger also found that bottom 10% leaders cost 4x the revenue created by middle 80% leaders.

– UNSW Business school research indicates that bad employees can bring down team productivity by 30-40%

More concisely put: If you invest $5m in new hire payroll to grow your company, then you expect these employees to generate at least $5m in value. However, if you’re able to attract more Strong Fits than Poor Fits, then the value you get from your investment will exceed $5m due to a favorable Strong to Poor Fits ratio. This means your workforce will be more productive and able to generate approximately an additional $1.5 more in revenue.

SmartRecruiters has used this framework to help a number of prospective customers convince executives of the necessity of investing in talent acquisition. Our application of data-driven metrics and ROI models are powerful tools for demonstrating to executives just how critical talent acquisition is to a company’s overall objectives. Through the framework of Hiring Success, TAs now have the ability to empirically prove that they are an invaluable organizational asset.